In the last section, I briefly suggested how the profits are to be distributed by using the ratio of 1:1:1:1:1:1. For me, such an explanation would be unsatisfactory. To better understand the distribution, I have created a fictitious spolu and given it a simplistic income statement. And from that income statement, I have created some accounting schedules to show how the profit is distributed.

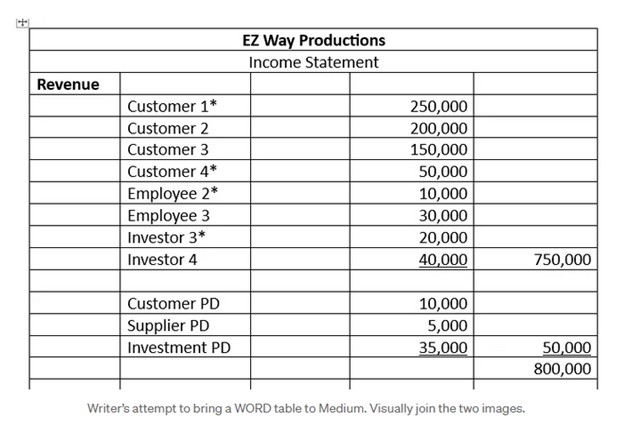

EZ Way Productions is a small business under the spolu network. What it does is not important, but here is its income statement for its last fiscal year. This data will later be turned into calculations for the profit distribution.

Writer’s attempt to bring a WORD table to Medium. Visually join the two images to make an income statement.

Notes

· The income statement should be ready about one month after EZ’s fiscal year end.

· PD is income from profit distribution that came from other spolus.

· The asterix (*) signifies customers and suppliers who belong to the spolu network. They will share in the profit distribution. The others will not.

· All employees will share in the profit distribution for employees. They need not be spolu members.

· The number beside each employee is the number of months the employee has worked for EZ Way. This will calculate the in-vesture ratio for each employee.

· Employees who formally belong to the spolu network and purchased from the EZ Way will share in the customer profit distribution.

· Pre-tax profits are $150,000. Spolus should pay taxes on these profits — before the profits are distributed.

· Stated post-tax profits are $120,000. The spolu is obligated to allocate at least 40% of this amount to the profit distribution. The senior management team decides to allocate 50%, so $60,000 goes out of the spolu as profit distribution.

· This means $10,000 goes to each set of stakeholders: investors, employees, customers, suppliers, philanthropy, and re-investment obligation. Remember this spolu ratio is 1:1:1:1:1:1.

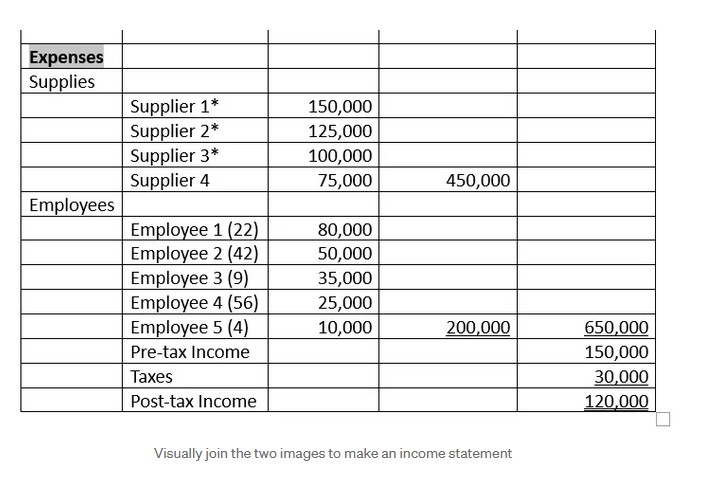

Investor Profit Distribution Schedule

The $10,000 allocated to the investors will be distributed pro-rata on the number of shares.

This profit distribution is $2.78 per share.

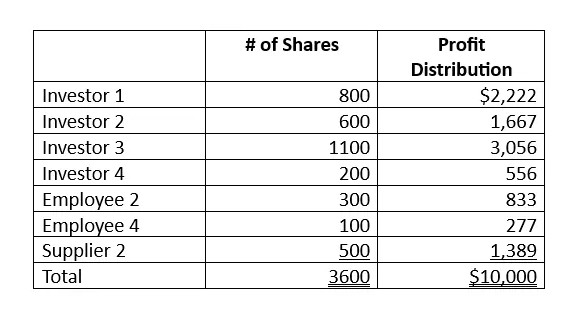

Employee Profit Distribution Schedule

All employees are eligible for the employee profit distribution. They need not join the spolu network.

Remember it takes 36 months of employment to be fully vested in the employee profit distribution. For employees with less than 36 months, their distributed profit will be prorated to the months worked prior to the income statement date.

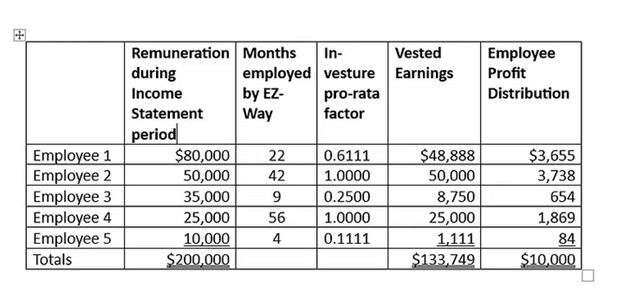

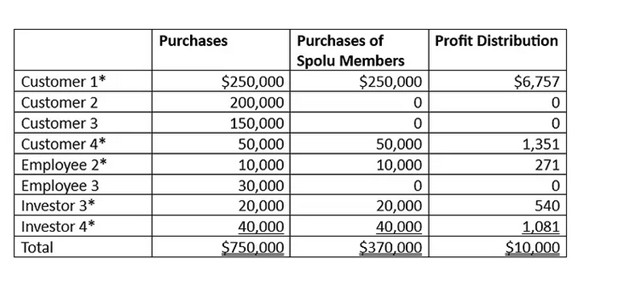

Customer Profit Distribution Schedule

Only the customers in the spolu network will get their share of the profit distribution. The distribution will be based pro-rata of the products/services purchased from EZ-Way.

Member customers are getting almost a 3% refund on purchases. This could entice the other customers to join the spolu network.

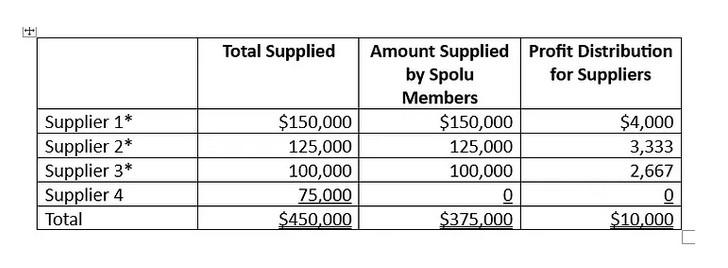

Supplier Profit Distribution Schedule

Remember that only suppliers already in the spolu network get the distribution.

Employee #2 Schedule

She is earning money from four places in EZ-Way Production:

Philanthropy

The charities supported by the spolu will get their share of the $10,000 allocated to philanthropy.

Re-investment

Another $10,000 will be invested into other spolus. The senior management team assigns a committee to inspect the spolu shares available for sale on the Spolu Exchange. They will purchase the shares that they think is a good investment decision for the spolu. The shares become property of the spolu. Profit distribution from these shares will come into the spolu. And these share can be sold if needed.

Published on Medium 2024

The Day American Democracy Died